A guide to China’s unique social media landscape

In industrialized countries, social media use is mostly homogenous and dominated by a small set of platforms. Due to various social and political circumstances, China has developed its own distinctive social media landscape. Given that many international companies are doing business in China today, it’s useful for communication managers to know which social media platforms are used within the country. At the IPRN conference held in Beijing in May 2018, Athena Wang from China’s leading PR agency Blue Focus gave an overview of current trends and important players in the Chinese market.

1. The status of social media in China:

At the end of 2017, 772 million Chinese citizens had access to the Internet, making them the largest online population in the world. Out of these users, 97.5% were using their phones to connect to the Internet. China’s mobile netizens already make many of their purchases on their smartphones. As the following graphic shows, a high percentage of users use their phones to make payments (70%), do their shopping (67.2%) and book their travel (39.7%).

Netizens who use their phones to access the Internet (Blue Focus 2018)

For China’s social media and e-commerce platforms, this means that “mobile first” is a must. Just 20 years ago, owning a computer was a rarity in China. However, smartphones have become prevalent in recent years and they have also become more affordable. This has resulted in a massive shift in the country’s media use: People read the news, use messaging services, watch movies, shop and pay their bills on their phones.

While many western social media platforms still have a high percentage of PC and laptop users, Chinese platforms that fail to adapt to the rapid increase in users that consume most of their media on their phones risk losing their competitive edge. In western countries, smartphone use is still more social and entertainment-driven. Social media are not seen as the primary sources of information and news. In contrast, Chinese users rely on their phones to manage most of their business and leisure activities. And apps such as WeChat and Sina Weibo are their main sources of news.

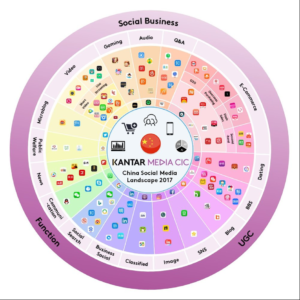

The prevalence of smartphones in China’s business environment and leisure time results in a highly competitive market for smartphone apps. As the following graphic illustrates, for every app which is dominant in the West such as YouTube, Facebook and Instagram, there are up to 20 apps with similar functions fighting for their share of the Chinese market.

China’s diverse social media landscape (Kantar Media CIC 2018)

2. Popular platforms and trends: the big two in China

Although China’s social media landscape is very diverse, just like in western countries, there are a few companies and platforms that have built up a large following of mobile netizens over time.

With roughly 980 million users, WeChat can be considered a combination of Facebook Inc.’s platforms Facebook, Whatsapp and Instagram. Sina Weibo, which has 411 million users, is the Chinese equivalent to the microblogging service Twitter.

In total, roughly three quarters of China’s population uses WeChat and more than one third uses Sina Weibo. In addition to the big two, there are several other unique platforms for video and live broadcasting, knowledge sharing and even karaoke, that are rapidly gaining users.

2.1. WeChat: the all-in-one “super app”

Due to China’s high number of smartphone users, it comes as no surprise that the mobile app WeChat dominates the Chinese social media rankings. More than 90% of its one billion monthly active users stem from China.

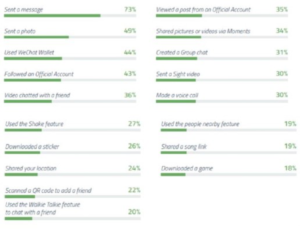

Originally created as a messenger app, WeChat progressively expanded its core functions: today it can be described as a “super app”, combining features we know from Facebook, Instagram, Skype, Whatsapp and even mobile payment providers like Paypal. From booking taxis, ordering food, playing games to following and connecting with businesses and celebrities, WeChat aims to provide a seamless user experience with no need to use any other apps. This makes it indispensable for reaching Chinese audiences.

WeChat’s multiple uses and their frequency of use (Blue Focus 2018)

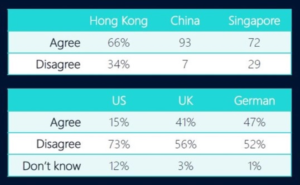

WeChat’s importance in Chinese society is also reflected in the way it has replaced emails as the country’s main means of business communication:

Messaging vs. emailing in the eastern and western worlds (Blue Focus 2018)

While in western business environments, emailing is more common or at least still equal to instant messaging platforms, in China, social media are the main channels for both business and social communications.

2.2. Sina Weibo: the Chinese Twitter

With over 400 million monthly active users, Sina Weibo is the most popular microblogging site in China and one of the main news sources for many Chinese netizens. Users can upload their own posts (with a 140-character limit), images and videos, follow other users and share content within the network.

As a mix of Facebook and Twitter, Sina Weibo is a fast-moving platform driven by trending topics, social buzz and key opinion leaders. Weibo counts more than 0.7 million verified media outlets and celebrities that shape public discourse in the country among its users, slowly forcing traditional media to transform and adapt by using existing online channels or establishing their own online profiles.

Sina Weibo’s user interface on desktop PCs (YouTube 2018)

2.3. Youku Tudou and iQiyi: video streaming is becoming more popular

Video streaming platforms are also becoming increasingly popular in China. At the moment, the two biggest brands are Alibaba’s Youku Tudou and Baidu’s iQiyi, both counting more than 500 million monthly active users.

In contrast to YouTube’s mostly user-generated content, iQiyi’s focus is on professional, high-quality video streaming like Netflix. Youku Tudou’s content is also shifting away from user-generated videos towards movies and television shows. The apps themselves keep evolving, and now incorporate services like games, movie tickets and other e-commerce options.

More than just video streaming – apps are expanding their portfolios (Blue Focus 2018)

2.4. Trending: live broadcasting & karaoke

Just like Twitch, which has gained massive – predominantly young – audiences over the last few years, live broadcasting apps like Yizhibo, Inke and Douyu have become very popular in China and have quickly moved beyond the niche of gaming. Users stream everything from video games to cooking. While broadcast apps attracted many authentic DIY users who created and shared their own content in the beginning, some users quickly professionalized and found fame through live broadcasting – a development also prevalent on western social media – especially on YouTube and Instagram.

Development of live broadcasting platforms from niche channels to mainstream apps (Blue Focus 2018)

A unique trend is reflecting one of China’s most popular leisure activities: karaoke. While the popular instant music video platform musical.ly is mostly aimed at young people in western countries, karaoke apps like Changba, Quanmin K Ge and Douyin reach a much wider audience in China with up to one third of the country’s population using at least one of them. Currently, user-generated content on these platforms reaches over one billion views per day – which is why many companies started collaborating with these platforms or popular users.

User-generated and promotional content coexist on popular karaoke apps

2.5. Knowledge sharing: Zhihu

Another example of a popular platform that started off based on user-generated content is Zhihu. With more than 100 million registered users – 26 million active users per month – Zhihu is one of China’s most important platforms for gathering information and expressing one’s opinion. Users can share their knowledge and experiences on a wide range of topics such as science, technology and their daily lives in a Q&A format similar to messaging boards like Reddit or Quora. Zhihu’s content can also be shared on other platforms like Weibo.

Zhihu’s smartphone user interface

2.6. LinkedIn: the odd one out

Microsoft’s business network LinkedIn is worth a mention as well: while its 30 million+ Chinese community is still relatively small compared to the country’s other platforms, it is one of the only global social media sites that is available in China. This makes LinkedIn extremely valuable for international businesses and communication managers.

3. China and the West – not so different after all?

While China’s social media landscape is vastly different from the rest of the world’s, recent developments and trends are similar in both cultures, regardless of the different apps and platforms.

Communication now flows from the bottom up not top-down. Social media platforms, and user-generated content and online influencers in particular, have changed how communications professionals address their stakeholders. Communications strategies in the digital ecosystem now focus on building a brand culture instead of simply showing brand features. Stories are being told through co-creation and dialogue instead of one-way top-down communication. Content is increasingly being delivered through first-hand experiences instead of simple sales measures.

Content is king. It’s hard to predict what kind of content will go viral online. But to achieve success with their messages to stakeholders, communications professionals need to deliver emotional and relatable content with real added value, not just glossy advertisements or pure facts. Telling a compelling, truthful story is what gets people to pay attention.

The line between online and offline is blurred. These days, many companies are using an integrated communication strategy, combining their online and offline presences to create a complete user experience and tell a consistent story across all channels.

Politics are bigger than ever on social media. In China and in the West, politicians and governments are using social media to inform and interact with their publics. They’re expanding their communications to social platforms to reach younger audiences and combine politics with trending topics. As social media reach major sections of a country’s population, they are also regularly subjected to new rules and regulations that influence the evolution of the social media landscape.

The Chinese government uses social media to reach younger audiences (Source: Blue Focus, 2018.)

Social media creates opportunities and challenges. Once a message is online, companies lose control of it. News spreads fast in social media – especially negative stories. In social media, users are the gatekeepers who decide which content will reach bigger audiences.

An Instagram post got Mercedes-Benz into trouble in China.

One example is Mercedes-Benz quoting the Dalai Lama – a very sensitive issue in China – in a campaign posted on Instagram. Once Chinese netizens became aware of this, an outcry followed, leading Mercedes-Benz to issue a public apology on its official Sina Weibo channel. The Ministry of Foreign Affairs also responded to Mercedes-Benz’s apology in an online statement. This shows that national borders are dissolving in today’s social media landscape. Once content is published online, it develops a life of its own – and communications professionals need to be prepared for that!

Authors: Athena Wang, supported by Dennis Lüneburger

Courtesy of Blue Focus, JP|KOM & IPRN

Blue Focus

Established in 1996, Blue Focus became the first publicly listed integrated communications group in China in 2010. Headquartered in Beijing, Blue Focus currently has more than 6,000 employees and generated a revenue of RMB 15.2 billion (USD 2.24 billion) in 2017, making it one of the world’s 10 biggest PR firms.

IPRN

The International Public Relations Network (IPRN) is one of the world’s largest independent agency networks. Founded in 1995, it is well established. Its 40 member agencies are located in 28 different countries all over the world.

Athena Wang

Athena Wang is a Senior Account Manager at Blue Focus in Beijing and a former chairman of the IPRN Executive Council. Blue Focus hosted the International PR Network’s Annual General Meeting and Conference in Beijing in May 2018.

Dennis Lüneburger

Dennis Lüneburger works as a Junior Consultant for IPRN member JP│KOM in Frankfurt, Germany.